Introduction to

Economics

Lesson 17 /07

PRICE

FIXING

This month saw

Australia’s third richest man, Richard Pratt, admit in the Federal

Court that his cardboard box manufacturing company Visy had agreed in

2000 to enter into a price fixing cartel with its major competitor Amcor.

The 2 companies had thereafter colluded until 2004.

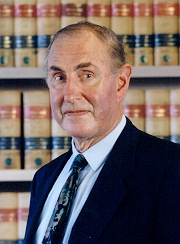

Pratt, aged 73, and no stranger to controversy, expressed

profound regret and remorse.

The prosecutor

suggested that an appropriate penalty was a fine of approximately $36

million. Estimate of the

alleged excess profit generated by and for the participants was $700

million. Prices were

allegedly approximately 15-20 % higher because of the collusion than

they should have been, although this particular allegation was strongly

disputed.

Apart from a

personal fortune, estimated at $5.4 billion, Pratt obviously has a lot

going for him. A stellar

list of people spoke up for him including the P M, John Howard and

Premier John Brumby. His

philanthropic record, including donations to the 2 major political

parties, [apparently running 3 to 1in favour of the Liberal Party] is

equally impressive.

The Australian

Competition & Consumer Commission [“ACCC”], the relevant

regulatory body that conducted the prosecution, did not proceed against

Amcor, since it was Amcor apparently that had blown the whistle on the

deal. Perhaps this was

because Amcor belatedly realized that Pratt was not keeping it anyway.

Pratt has stated

that in entering the deal he had his fingers crossed behind his back.

Somewhat akin to the Nazi- Soviet non -agression pact of 1939,

his purpose was to end a damaging price war then going on between the 2

companies, thereby enabling Visy to engage in other forms of more

advantageous, competitive actions against its rival.

In this he seems to have been successful since thereafter market

share, which had been approximately equal, swung markedly in favour of

Visy.

Apart from fines,

and regulatory constraints, such as having to appoint former ACCC chief

Allan Fels to head its Trade Practices Compliance Committee, it is

apparently unlikely that the court will impose any other penalties. In particular there will be no prison sentences.

Despite indicating an intention to do so about 4 years ago, the

Federal government has not yet enacted legislation enabling this to

occur. Given the storm of

criticism that has now arisen, and the Labor Party’s pledge to do so

if elected, this may well change in the near future.

Regardless of the

final outcome of the present Federal Court proceedings, the troubles of

the 2 companies involved are far from over.

Amcor is apparently facing a class action seeking damages of

hundreds of millions of dollars, launched by law firm

Maurice Blackburn Cashman. It

is likely now that Visy will soon face the same.

What is Price

Fixing ?.

The relevant

legislation is the Commonwealth Trade Practices Act SS 45,45A, 45B and

45C. The ACCC website

contains a definition and an explanation.

It suggests that in essence, price fixing is about businesses

colluding rather than competing. It

requires the following elements;

·

A contract, arrangement or

understanding between businesses

·

Which businesses are in

competition with each other

·

A provision of which has

the purpose or likely effect of fixing, controlling or maintaining

prices.

It is the

requirement of consensus that is crucial.

Parties acting in parallel, [referred to as parallel conduct],

are not necessarily colluding. A

business setting a price, which is then matched by its competitors, will

in the absence of collusion, not constitute price fixing.

Price fixing can

occur in various ways, including, for example, suppliers colluding to

fix a price to sell to the public generally, to fix a price to supply a

particular person or group of persons, or a geographic area or areas, or

buyers agreeing to buy only at a fixed price .

Again various suppliers can agree to submit the same price in

purported compliance with an invitation to provide competitive tenders.

Until WW2, anti

price fixing laws were largely a preserve of the USA.

Since then the number of countries with laws against such

activities have grown significantly, and today such legislation exists

in more than 70 countries, including Canada, Australia, various

countries of the EU, and some of the more industrialized nations of East

Asia. While most economists probably support laws prohibiting

price fixing, or even criminalizing it, a significant number, to the

contrary, support legalization.

Some

Arguments for Prohibiting Price Fixing

Price fixing is

fraud. As opponents point

out, this does not necessarily follow.

If price fixing was legal then parties could declare that their

prices were fixed and allow purchasers to make up their own mind whether

to purchase. Of course this would not apply to competitive tender bids

where the bids are otherwise required by the rules of the tender to be

competitive bids.

Price fixing

creates increased market power in the suppliers and enables them to

charge a higher price than would otherwise prevail in the market to the

damage of consumers.

Some

Arguments for Permitting Price Fixing

The real world is

dynamic, not static. It is

not possible to calculate what a market price would be other than

through the operation of the market itself.

Price fixing agreements can be socially beneficial, and cost

effective for the participants creating stability, predicability and

efficiency. As long as

entry into a market is free, excess profits will be competed away by new

participants.

In the absence of

government enforcement, price fixing agreements invariably tend to fall

apart. Arguably however, if

such agreements are illegal or at least not enforceable in a court they

are more likely to do so, and more quickly

The cost of

regulating and enforcing anti price fixing laws are major.

In so far as penalties are initially imposed on the producers,

they are ultimately passed on to the community generally. It is suggested that one way around this dilemma is to impose

prison sentences rather than fines.

“People of the

same trade seldom meet together, even for merriment and diversion, but

the conversation ends in a conspiracy against the public, or in some

contrivance to raise prices. It

is impossible indeed to prevent such meetings, by any law which either

could be executed, or would be consistent with liberty and justice.”

Adam Smith The Wealth of Nations

1776

David Sharp

22 October 2007